Introduction: Why QuickBooks is a Game-Changer for Businesses

Running a business is exciting, but let’s be honest—managing finances can feel like a nightmare. Whether you’re a small business owner, freelancer, or managing a large enterprise, keeping track of expenses, invoices, and payroll is overwhelming.

Enter QuickBooks, a lifesaver for business owners. It’s an all-in-one accounting software designed to simplify bookkeeping, save time, and ensure your finances are in check. But is it the right fit for your business? Let’s dive in and find out.

What is QuickBooks?

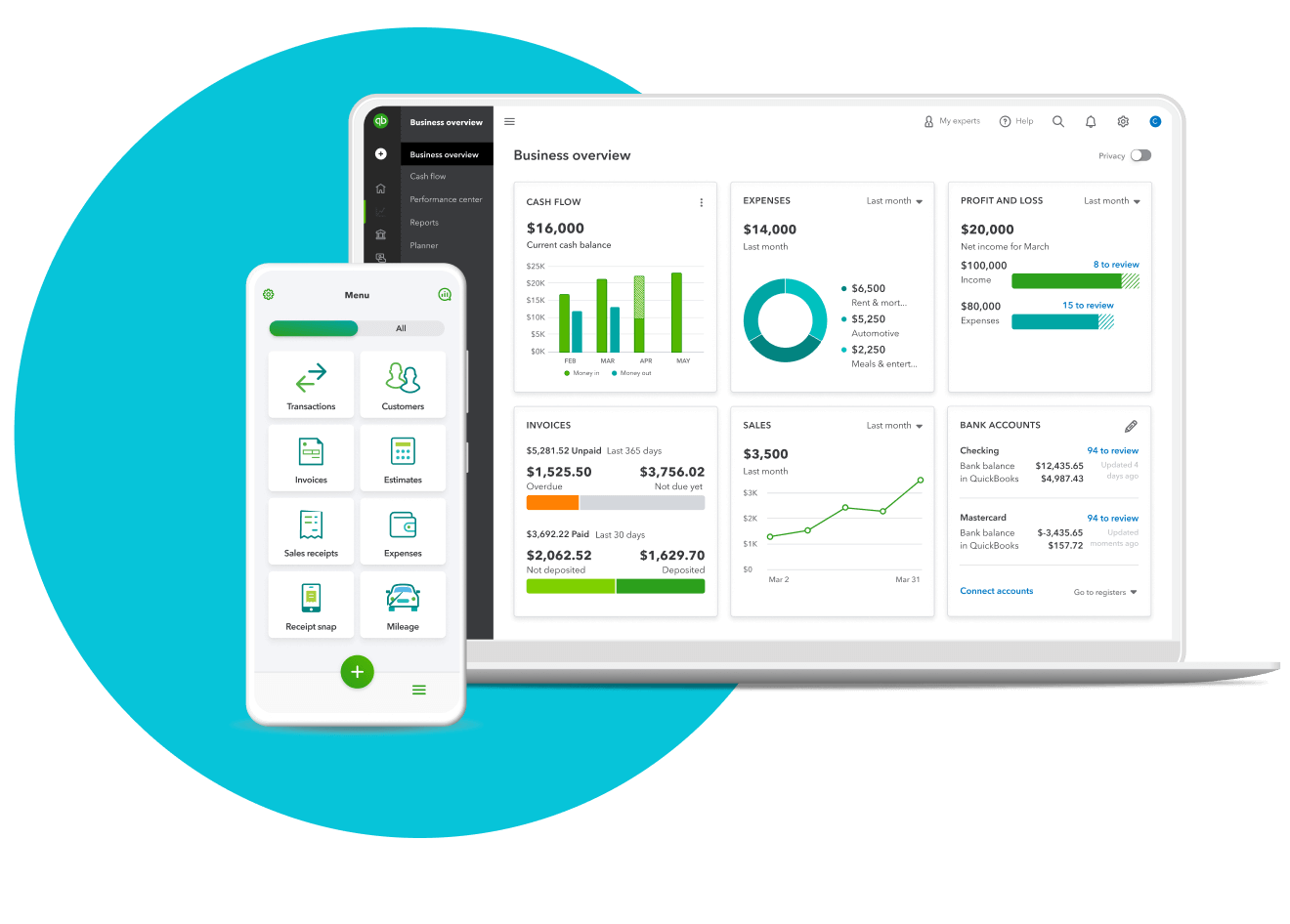

QuickBooks is an accounting software developed by Intuit that helps businesses manage their finances efficiently. It allows users to track income and expenses, generate invoices, handle payroll, and prepare tax reports—all in one platform.

Whether you’re an entrepreneur, freelancer, or a large corporation, QuickBooks has different versions to suit your needs, including:

- QuickBooks Online – Cloud-based and accessible anywhere.

- QuickBooks Desktop – Traditional software with advanced features.

- QuickBooks Self-Employed – Designed for freelancers and independent contractors.

- QuickBooks Enterprise – A robust solution for larger businesses.

Why QuickBooks? The Benefits You Can’t Ignore

1. Easy to Use

QuickBooks is designed for non-accountants. Its user-friendly interface makes it easy to navigate, even if you have zero accounting knowledge.

2. Automates Your Finances

Say goodbye to manually tracking expenses and invoices. QuickBooks automates everything, from categorizing transactions to reconciling bank statements.

3. Saves Time

With automation and pre-built templates, QuickBooks cuts down the time spent on bookkeeping so you can focus on growing your business.

4. Generates Professional Invoices

Create customized invoices, track payments, and send reminders to clients—all in a few clicks.

5. Real-Time Financial Reports

Stay on top of your finances with real-time profit and loss statements, balance sheets, and cash flow reports.

6. Tax Preparation Made Easy

No more scrambling during tax season. QuickBooks organizes your financial data, making tax filing a breeze.

7. Payroll Integration

Managing employee payroll has never been easier. QuickBooks ensures employees get paid on time and taxes are calculated correctly.

How to Get Started with QuickBooks in 5 Easy Steps

Step 1: Choose the Right Version

Depending on your business needs, pick between QuickBooks Online, Desktop, Self-Employed, or Enterprise.

Step 2: Set Up Your Business Profile

Enter your company details, connect your bank account, and configure tax settings.

Step 3: Customize Your Dashboard

Tailor QuickBooks to fit your business by setting up customized invoice templates, payment reminders, and tracking categories.

Step 4: Automate Transactions

Link your bank account and credit cards for automatic expense tracking. Set up recurring invoices and bill payments.

Step 5: Generate Reports & Monitor Finances

Regularly check QuickBooks’ reports to track your business performance and financial health.

Who Should Use QuickBooks?

QuickBooks is perfect for: ✅ Small business owners – Manage cash flow, expenses, and taxes easily.

✅ Freelancers – Keep track of invoices, payments, and expenses in one place.

✅ Mid-size companies – Get detailed financial reports and payroll management tools.

✅ E-commerce businesses – Integrate with platforms like Shopify and track sales efficiently.

✅ Large enterprises – Use QuickBooks Enterprise for robust financial management.

QuickBooks Pricing Plans

QuickBooks offers flexible pricing based on your business needs:

| Plan | Best For | Price (Approx.) |

|---|---|---|

| Self-Employed | Freelancers & Contractors | $15/month |

| Simple Start | Small Businesses | $25/month |

| Essentials | Growing Businesses | $50/month |

| Plus | Mid-size Businesses | $80/month |

| Advanced | Large Enterprises | $180/month |

Pricing varies based on promotions and features. Always check QuickBooks’ official site for updates.

Common Mistakes to Avoid When Using QuickBooks

❌ Ignoring Regular Updates – Keeping your QuickBooks software updated ensures you have the latest security and features.

❌ Not Backing Up Data – Always back up your financial data to prevent loss due to system failures.

❌ Incorrectly Categorizing Transactions – This can mess up your financial reports and tax filings.

❌ Skipping Bank Reconciliation – Regularly reconcile your bank statements to avoid discrepancies.

Conclusion: Is QuickBooks Worth It?

Absolutely! QuickBooks simplifies accounting, saves time, and helps businesses stay organized. Whether you’re a freelancer, startup, or large business, this software adapts to your needs and keeps your finances in check.

Want to take the headache out of bookkeeping? Try QuickBooks today and experience stress-free financial management!

FAQs About QuickBooks

1. Is QuickBooks difficult to learn?

Not at all! QuickBooks is designed for beginners with no accounting experience. Plus, there are tons of tutorials available.

2. Can I use QuickBooks on my phone?

Yes! QuickBooks Online has a mobile app that lets you manage finances on the go.

3. Does QuickBooks support multiple users?

Yes! Higher-tier plans allow multiple users to access and manage financial data.

4. Is QuickBooks good for personal finance?

QuickBooks is mainly for businesses, but QuickBooks Self-Employed can help freelancers manage personal and business expenses.

5. Can QuickBooks integrate with other apps?

Yes! QuickBooks integrates with PayPal, Shopify, Stripe, and hundreds of other business tools.