Introduction

Running a business comes with many responsibilities, and managing finances is one of the most crucial. Whether you’re a freelancer, small business owner, or accountant, having reliable accounting software can make a world of difference. That’s where QuickBooks accounting software comes in.

QuickBooks is one of the most popular accounting solutions, offering a range of features to simplify bookkeeping, payroll, and financial reporting. In this guide, we’ll explore why QuickBooks is the go-to choice for businesses and how it can help you streamline your financial operations.

What is QuickBooks Accounting Software?

QuickBooks is an accounting software developed by Intuit that helps businesses manage their finances with ease. It automates essential financial tasks, such as invoicing, expense tracking, tax preparation, payroll processing, and financial reporting.

This software is available in different versions, including QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed, catering to various business needs.

Why Choose QuickBooks for Your Business?

1. Easy to Use

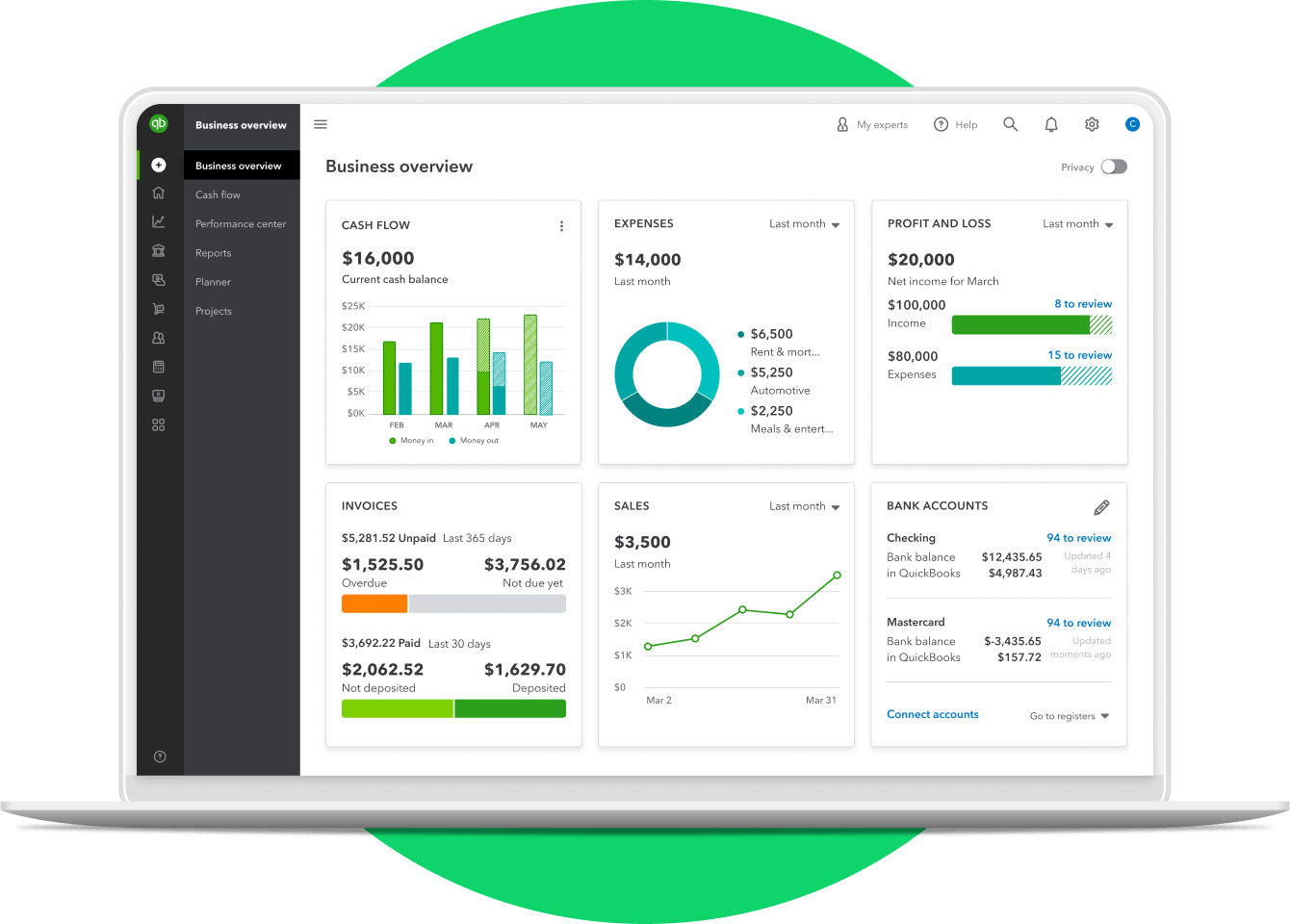

QuickBooks is designed for users with little to no accounting experience. The intuitive dashboard, user-friendly interface, and easy-to-follow setup make it accessible for small business owners.

2. Automates Accounting Tasks

Forget the hassle of manual bookkeeping! QuickBooks automates recurring tasks such as bill payments, payroll processing, and invoicing, saving you time and reducing human errors.

3. Cloud-Based Accessibility

With QuickBooks Online, you can access your financial data from anywhere with an internet connection. This is perfect for business owners who need to manage their accounts remotely.

4. Seamless Integration

QuickBooks integrates with a variety of third-party apps like PayPal, Shopify, Square, and bank accounts, allowing you to sync transactions effortlessly.

5. Financial Reporting & Insights

Generate detailed financial reports such as profit & loss statements, cash flow reports, and balance sheets with just a few clicks. These insights help in making informed business decisions.

6. Tax Preparation Made Easy

QuickBooks helps keep track of tax-deductible expenses and prepares tax reports, making tax filing a breeze. It even integrates with TurboTax for a smooth tax season.

7. Multiple Plans for Different Business Needs

Whether you’re a freelancer, small business, or a large enterprise, QuickBooks offers different pricing plans and features to fit your needs.

Key Features of QuickBooks

1. Invoicing & Payments

- Create and send professional invoices

- Accept online payments via credit cards or bank transfers

- Track payment status and send reminders

2. Expense Tracking

- Automatically categorize expenses

- Upload and store receipts for tax deductions

- Monitor business spending in real-time

3. Payroll Management

- Automate employee payments and tax filings

- Direct deposit options available

- Ensure compliance with labor laws

4. Inventory Management

- Track stock levels and get alerts when inventory is low

- Manage purchase orders and supplier payments

- Sync with e-commerce platforms

5. Bank Reconciliation

- Connect bank accounts and credit cards

- Match transactions automatically to avoid discrepancies

- Spot fraudulent or duplicate transactions

6. Multi-User Access

- Allow multiple users to access QuickBooks

- Assign different roles and permissions

- Collaborate with accountants and financial advisors

How to Get Started with QuickBooks?

Step 1: Choose the Right Plan

QuickBooks offers different plans, including:

- QuickBooks Self-Employed (for freelancers)

- QuickBooks Simple Start (for small businesses)

- QuickBooks Essentials (for growing businesses)

- QuickBooks Plus & Advanced (for larger enterprises)

Step 2: Set Up Your Account

After choosing a plan, sign up and enter your business details. You can customize settings to match your accounting needs.

Step 3: Connect Your Bank Account

Sync your business bank account and credit card to automatically import transactions.

Step 4: Create & Manage Invoices

Start sending invoices and tracking payments right away.

Step 5: Automate Payroll & Expenses

Set up payroll, categorize expenses, and automate recurring transactions.

Who Should Use QuickBooks?

- Small business owners who need a simple accounting solution

- Freelancers & self-employed professionals who want to track income and expenses

- Medium & large businesses looking for advanced financial management tools

- E-commerce store owners who need inventory tracking and tax automation

- Accountants & bookkeepers managing multiple clients

Conclusion

quick book accounting software is an all-in-one financial management tool that helps businesses save time, reduce errors, and stay on top of their finances. Whether you’re a small business owner or a freelancer, QuickBooks offers the perfect solution to keep your books in order.

FAQs

1. Is QuickBooks free?

No, QuickBooks is a paid software, but it offers a free trial for new users.

2. Can I use QuickBooks on my phone?

Yes! QuickBooks has a mobile app for iOS and Android, allowing you to manage finances on the go.

3. Do I need accounting knowledge to use QuickBooks?

Not at all! QuickBooks is designed for beginners with no prior accounting experience.

4. Which version of QuickBooks is best for small businesses?

QuickBooks Online Essentials or QuickBooks Plus are ideal for small businesses.

5. Does QuickBooks support multiple currencies?

Yes, QuickBooks Online supports multi-currency transactions.

6. Can I switch from QuickBooks Desktop to QuickBooks Online?

Yes, QuickBooks provides an easy migration process to switch from Desktop to Online.